CMC Markets专栏:中石油2015年利润大跌

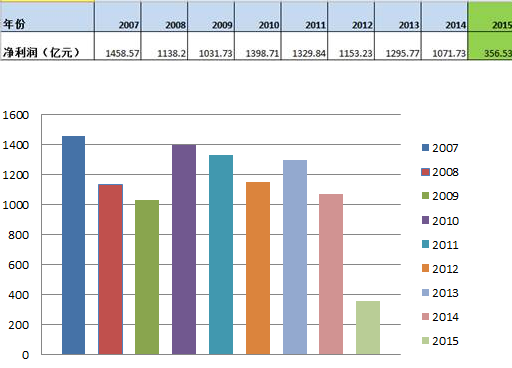

根据中国石油最新发布的2015年年报显示,公司2015全年净利润额为355亿人民币,同比下滑66.9%,创自1999年以来最差表现。公司年报中显示由于国际能源价格大跌,250亿元出现减记。此前在1月份,公司年度业绩预告称,按照中国企业会计准则,2015年净利润较上年同期将减少60%-70%。目前中国石油每股收益达0.19元,公司拟派发每股人民币0.02486元。

中国石油净利润(2007-2015)

国际油价跳崖式下跌是中石油利润额下滑的主要原因

自2014年6月份国际石油价格便开始跳崖式的下跌趋势,英国布伦特原油期货价格由102美元/桶持续下行至目前的40美元附近,2014年跌幅达近50%,215年跌幅近35%。美国西得克萨斯原油价格出现类似跌幅,自2014年高位90美元附近至今下跌近57%。为推进天然气价格市场化改革,国家发改委在去年11月份宣布将天然气最高门站价格下调0.7元/立方米,进而压低了国内石油企业的利润。中国石油公司2015年营业额为17254.28亿元,比2014年同期下降24.4%,全年净利润下跌至355.17亿。

国际油价的大幅下滑迫使全球石油公司减记其资产与削减资本支出。中国海洋石油公司也在2016年经营策略展望公告中表示,预计今年的资本支出总额将低于600亿元,较2014年1070亿元下降43%。

目前,欧派克成员国与其它非成员产油大国正在就冻结石油产量事宜进行协商,目前并没有实质行动。2月16日沙特阿拉伯发起, 联合俄罗斯、奎瓦特与委内瑞拉在达成意向将联合意向对原油产量进行冻结. 上周欧派克国家秘书长阿普杜拉.巴德里宣布4月17日,将有15或者16个国家将在奎瓦特的达哈共同协商关于石油产量冻结事宜。但对于伊朗是否参加不确定。

油价可能会在本年度有所反弹

乐观的一面可以看到,国际油价自今年2月份以来出现触底性反弹,英国布伦特原油与美国西得克萨斯原油价格分别有39%与35%的上涨。据美国能源信息管理局统计,美国正在减少石油产量。如果下个月欧派克国家与俄罗斯等国能够达成解决石油供给过剩的协议,国际油价有望进一步反弹。

中国石油仍然预计在2016年将减产2.7%至14.5亿桶。昨日中国石油股票在A股市场上下跌0.13%至7.78元/股,较1月27日低点6.99有所上涨,浇2015年高位15.36下跌49.3%;在香港市场上昨日呈现收涨0.9%至5.37港币/股。

上海证券交易所中国石油股价走势

数据来源:新浪财经

据外媒消息,中国石油公司可能进行股份制改革成为独立经营的控股集团公司,但根据其母公司中国天然气表示并没有官方确认此事宜。

Contact Information

如有更多问题,欢迎致电:

澳大利亚免费中文电话:1300 668 268

Disclaimer AU

Investing in CFDs carries significant risks and is not suitable for all investors. Losses can exceed your deposits. You do not own, or have any interest in, the underlying assets. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The information in this Market Commentary has been prepared by CMC Markets using information from external sources, believed to be accurate and reliable at the time it was sourced. It is general information only. Neither CMC Markets, its subsidiaries, nor any director, employee or agent of CMC Markets gives any guarantee, representation or warranty as to the reliability, accuracy or completeness of the information contained in the Market Commentary, nor accepts any responsibility or liability arising in any way (including by reason of negligence) for errors in, or omissions from, the information in the Market Commentary to the fullest extent permitted by law. In preparing this Market Commentary, CMC Markets did not take into account your objectives, financial situation and needs. Consequently, you should consider the information in light of your objectives, financial situation and needs. It's important for you to consider the relevant Product Disclosure Statement ('PDS') and any other relevant CMC Markets Documents before you decide whether or not to acquire any of the financial products. Our Financial ServicesGuide contains details of our fees and charges. All of these documents are available at cmcmarkets.com.auor you can call us on 1300 303 888.

Disclaimer NZ

Investing in CFDs carries significant risks and is not suitable for all investors. Losses can exceed your deposits. You do not own, or have any interest in, the underlying assets. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The information in this Market Commentary has been prepared by CMC Markets using information from external sources, believed to be accurate and reliable at the time it was sourced. It is general information only. Neither CMC Markets, its subsidiaries, nor any director, employee or agent of CMC Markets gives any guarantee, representation or warranty as to the reliability, accuracy or completeness of the information contained in the Market Commentary, nor accepts any responsibility or liability arising in any way (including by reason of negligence) for errors in, or omissions from, the information in the Market Commentary to the fullest extent permitted by law. In preparing this Market Commentary, CMC Markets did not take into account your objectives, financial situation and needs. Consequently, you should consider the information in light of your objectives, financial situation and needs. It's important for you to consider the relevant Product Disclosure Statement ('PDS') and any other relevant CMC Markets Documents before you decide whether or not to acquire any of the financial products. Our Financial ServicesGuide contains details of our fees and charges. All of these documents are available at cmcmarkets.co.nzor you can call us on 0800 26 26 27.

Author photo

Author profile

Tina Teng在2015年6月份加入CMC Markets 担任销售与客户培训主管职务,负责亚太地区客户的培训和经济评论的撰写工作。她具有其独树一帜的市场视角和技术分析方法,认为金融市场是集历史,经济,政治,心理学与哲学于一身的学问。技术分析是市场基本面的可视性技术语言;而对于技术性语言的解读与对各国家经济、政治与历史背景分析的结合,与对投资心理状态的理解才会是对金融市场最全面的感知。自2012至2015年,Tina Teng曾任职金融经纪公司客户服务部经理为客户提供外汇差价合约方面的培训工作。此前,自2005年至2009年,她曾经在中国中央电视台广告经济中心任职,负责撰写中国广告经济方面的评论文章,造就了她对于中国经济现状和企业现状有深入的理解和敏锐的洞察力。

+61

+61 +86

+86 +886

+886 +852

+852 +853

+853 +64

+64